Unlocking Investment in Somalia’s Livestock Sector

The livestock sector is the backbone of Somalia’s economy, representing one of the few production systems that remained resilient despite decades of civil conflict.

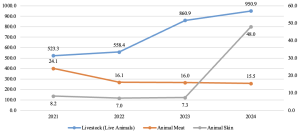

Agriculture contributes approximately 65% of Somalia’s Gross Domestic Product (GDP), with livestock alone accounting for nearly 70% of GDP and 85% of total exports. Over 23% of the population engages in agro-pastoralism, while nomadic pastoralists—who form around 26% of the population—are the primary custodians of livestock production. Somalia plays a crucial role in the global live animal trade, exporting over 20 million heads of sheep and goats between 2018 and 2024. In 2023 alone, the livestock sector generated nearly $1 billion in revenue, marking a 92% increase from $558.4 million in 2022.

Figure 1: Somalia’s Livestock Exports (2021–2024)

Challenges Facing Somalia’s Livestock Sector

- Export Restrictions and Trade Barriers: The sector has been affected by export bans, particularly from Saudi Arabia. The most recent ban, imposed in 2016, led to a 50% decline in exports, before being lifted in 2022.

- Climate Change and Drought: Recurrent droughts severely impact pasture availability and water resources. The devastating 2017 drought led to the loss of 6.4 million livestock, valued at over $350 million (CBS, 2024), with indirect losses amounting to $1.2 billion.

- Weak Infrastructure: The absence of modern slaughterhouses, cold storage, and transport facilities limits value-added processing, with 99% of Somalia’s livestock exports being live animals.

- Animal Health and Disease Control: Poor veterinary infrastructure and inadequate disease control mechanisms hinder trade. Common livestock diseases, including Foot and Mouth Disease (FMD), Brucellosis, and Peste des Petits Ruminants (PPR), impact productivity and reproduction rates.

- Limited Financial Access: Herders and traders struggle to access credit and investment, restricting their ability to modernize operations and increase productivity.

Growth Opportunities: Unlocking the Potential of the Somali Livestock Sector

- Value Addition and Processing Expansion: Investing in modern meat processing, leather tanning, and dairy production facilities could boost export earnings by over $1 billion annually. Strengthening supply chain infrastructure, such as cold storage and packaging, would enhance Somalia’s competitiveness in global markets.

- Market Diversification: Reducing dependency on Middle Eastern buyers by exploring export opportunities in Africa, Asia, and Europe can stabilize demand. Strengthening branding and halal certification will further support market penetration into premium segments.

- Infrastructure and Veterinary Services Investment: Upgrading quarantine stations, disease surveillance systems, and transport networks will improve compliance with international trade regulations. Establishing modern veterinary and pharmaceutical centers will also enhance livestock health management.

- Financial Inclusion and Investment Facilitation: Expanding microfinance, livestock insurance, and credit facilities for herders, cooperatives, and processors will enhance sector resilience. Public-private partnerships and foreign investment could further drive modernization efforts.

Market Potential and Investment Prospects

Somalia’s livestock sector, valued at approximately $12.4 billion, remains largely underutilized in terms of value-added processing. Fresh meat consumption has been rising, driven by increasing local demand and expanding export opportunities. In 2023, Somalia exported approximately $16 million worth of fresh meat to the Middle East, a region with consistently high demand for livestock and meat products. However, the sector continues to operate below its full potential due to inadequate slaughterhouse infrastructure and weak marketing systems.

Milk is the most economically significant livestock product, valued at $6.58 billion in 2013, with Somalia recognized as the world’s leading producer of camel milk—a staple preferred over cow’s milk by Somali consumers. The dairy sector holds significant growth potential, particularly in milk and processed dairy products. Despite strong demand for fresh milk, the industry lacks large-scale collection, pasteurization, and packaging infrastructure. Investments in dairy cooperatives, cold storage facilities, and processing plants could help meet rising domestic and regional demand while reducing reliance on imports.

Hides and skins currently play a minor role in Somalia’s livestock value chain, primarily serving as by-products for domestic use. Raw hides are mainly exported, with small quantities used in jewelry and accessories. In 2023, Somalia exported approximately $7 million worth of hides and skins to Dubai, Pakistan, the UAE, China, and Italy. Expanding the leather processing industry and attracting foreign investment could unlock new export opportunities, adding value to Somalia’s vast livestock resources.

Key Investment Opportunities

- Solar-Powered Meat Processing Facilities – Establishing energy-efficient meat processing plants to meet export standards, particularly for Gulf markets.

- Milk Processing Plants – Developing dairy processing infrastructure to capitalize on Somalia’s strong camel milk production.

- Livestock Export Intelligence Database – Enhancing market intelligence and data-driven trade decision-making.

- Veterinary Services & Pharmaceuticals Centers – Expanding disease control, vaccination, and veterinary support systems.

- Livestock Breeding & Feeding Programs – Introducing modern breeding techniques and optimized feeding systems to enhance livestock productivity.

- Modernizing Slaughterhouses & Cold Storage – Upgrading facilities to meet international hygiene and halal certification standards.

Future Outlook and Development Interventions

Strategic interventions by the Somalia Development and Reconstruction Bank (SDRB) could unlock the sector’s full potential. By prioritizing infrastructure development, market diversification, and financial inclusion, Somalia can transform its livestock sector into a globally competitive industry. With the right investments and policy support, Somalia’s livestock sector holds the promise of sustained economic growth, job creation, and improved resilience against climate and trade shocks.