Understanding Somalia’s Agricultural Sector

Somalia’s agricultural sector represents a paradox of significant economic contribution alongside substantial untapped potential.

As the cornerstone of the nation’s economy, agriculture accounts for 19.7% of GDP as a standalone crop sector and 65% when combined with livestock. Despite this critical role, systemic challenges have prevented the sector from achieving its full productive capacity. This analysis examines the current state of Somalia’s agricultural sector, identifying key challenges while highlighting strategic opportunities for transformational growth that could fundamentally reshape the nation’s economic landscape.

The sector has endured a turbulent history. Since the civil war in 1991, agricultural outpu’ fell by 40-50% due to destroyed irrigation infrastructure and displacement. However, recovery efforts since 2010 have shown promising signs, with sorghum production increasing by 22% and sesame exports reaching $50 million annually.

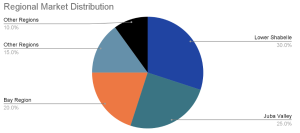

The agricultural landscape in Somalia is characterized by distinct regional variations. Lower Shabelle dominates with 30% of overall output, specializing in high-value cash crops. Juba Valley follows with 25%, focusing on staple food production, while Bay Region contributes 20% with a diverse mix of crops. Urban Peripheries play a crucial role in supplying fresh produce to population centers.

Key Takeaways

- Economic Significance: Agriculture is the cornerstone of Somalia’s economy, contributing significantly to GDP and employing a large portion of the population.

- Challenges: The sector faces major hurdles including post-harvest losses (30-40% annually), input shortages (only 15-20% of farmers use improved seeds), and irrigation deficits (70% of crops rely on erratic rainfall).

- Regional Variations: Different regions specialise in different crops and face unique challenges that require targeted interventions.

- Investment Opportunities: Strategic investments in cold storage infrastructure, processing hubs, and irrigation rehabilitation could yield substantial returns and transform the sector.

- Policy Needs: Strengthening the policy and regulatory framework is essential for sustainable growth and development of the agricultural sector.

The Current State of Somali Agriculture

Agriculture is the backbone of Somalia’s economy, contributing 19.7% to the GDP as a standalone crop sector and 65% when combined with livestock. The total crop production value is estimated at $540-$680 million annually. However, this is overshadowed by a $190 million trade deficit, with $460 million in imports versus $270 million in exports.

The agricultural sector has experienced significant fluctuations over the past few decades. After the civil war in 1991, agricultural output fell by 40-50% due to destroyed irrigation infrastructure and displacement. Recovery efforts since 2010 have shown promising signs, with sorghum production increasing by 22% and sesame exports reaching $50 million annually. Maize yield has improved by 18% with partial irrigation rehabilitation, but challenges remain in reaching pre-war production levels.

Yield gaps are significant for staple crops, with wheat producing 401.3 kg/ha and groundnuts 1,079.5 kg/ha—both 40-60% below regional benchmarks. Over 70% of crops rely on erratic rainfall, causing yield volatility. For example, sorghum’s current output is 84% below its potential under optimal irrigation.

Post-harvest losses are substantial, with 30-40% of perishables (tomatoes, citrus, bananas) spoiling due to inadequate storage and handling, resulting in $100-$150 million in annual losses. Less than 10% of produce is processed, with sesame exports lacking value-added processing.

Input shortages are another critical issue. Only 15-20% of farmers use improved seeds, resulting in suboptimal yields. For example, maize yields average 750 kg/ha compared to the global average of 5,000 kg/ha. Water management is another critical issue, with only 30% of arable land irrigated.

Investment Opportunities

Strategic investments could transform the sector:

- Cold Storage Infrastructure: Requires $20 million investment with potential 18-22% annual ROI.

- Sesame Processing Hubs: Requires $60 million investment with potential 30-35% margins.

- Irrigation Rehabilitation: Requires $50 million investment with potential 25-30% ROI.

Addressing input supply gaps is crucial:

- Seeds and Fertilizers: Only 15-20% of farmers use improved seeds.

- Water Management: $50 million needed to rehabilitate 50,000 hectares of irrigation infrastructure.

- Mechanization: Over 80% of farming is manual with negligible machinery adoption.

Strategic Recommendations

- Input Access: Subsidize drought-resistant seeds and fertilizers to raise maize yields.

- Storage Infrastructure: Build regional cold-storage units to reduce post-harvest losses.

- Market Linkages: Develop digital platforms to connect farmers directly to buyers.

- Export Certification: Train agribusinesses in international phytosanitary standards.

Policy and Regulatory Framework

Current policies are insufficient, with 7 policies drafted but 4 pending adoption. Outdated legislation and limited enforcement capacity hinder sector development. No national seed certification system exists, and only 8% of mills meet food safety standards.

Technology and Innovation

Technology adoption rates are low:

- Fertilizers: Application rates average 4 kg/ha, far below regional standards.

- Improved Seeds: Less than 15% of farmers use certified seeds.

- Mechanization: Only 5% of farms use machinery.

- Digital Tools: Less than 10% of farmers access mobile-based advisory services.

Research and development gaps are significant, with no operational national agricultural research center since 1991. Dependency on underfunded regional universities for crop trials and annual R&D expenditure of less than $2 million limits progress.

Future Outlook

With strategic investments and policy reforms, Somalia’s agricultural sector has the potential to drive significant economic growth and enhance food security.

Key steps include:

- Short-Term Actions: Invest in cold chain infrastructure, rehabilitate rural roads, launch mobile-based farmer training programs.

- Medium-Term Strategies: Develop sesame processing hubs, expand irrigated land, establish phytosanitary labs.

- Long-Term Planning: Develop export corridors, invest in climate-resilient infrastructure, create a national market information system.

Conclusion

Somalia’s agricultural sector stands at a crossroads. Despite facing numerous challenges, its potential to drive economic growth and improve food security is immense. By addressing critical supply chain bottlenecks, enhancing farmer capacity through training and extension services, strengthening market linkages, and fostering innovation through R&D investments, Somalia can transform its agricultural sector into a powerhouse that benefits both its economy and its people.